Optimize routing for quicker, cost effective payments processing

Sending money across borders today requires series of intermediaries for both clearing and settlement, each adding time and cost to the process.

Using the power of AI, the goal is to assist banks in discovering the channel which is the most cost effective, transparent, accessible, and fast to banks' customers.

Cross-border Payments & Money Transfers

Cross-border payment is divided into three distinct steps and our Proprietary AI model optimises each of these steps for lowest cost and fastest speed.

Each step is optimized with our proprietary AI model for efficiency.

Optimizing cross-border payments is crucial for offering the best customer experience and removing frictions from the process.

For Business For Individuals

A thoughtful way to pay

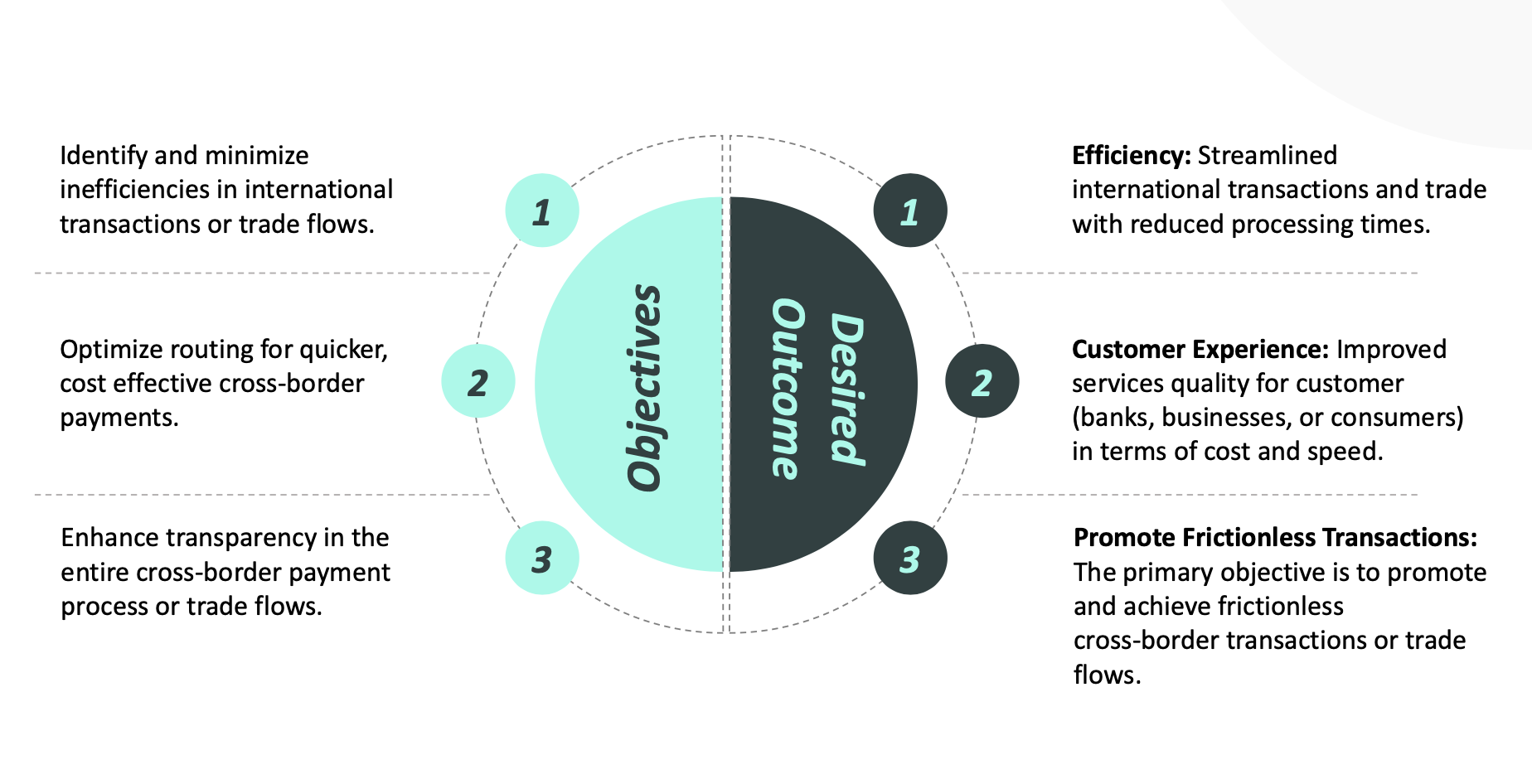

As financial institutions strive for efficiency and customer satisfaction in cross-border transactions, there is a pressing need to address challenges related to prolonged processing times and intricate routing.

Teams should focus on all aspects of the payments journey, including pre-transaction, routing, and post-payment tracking. Teams can choose to focus on either the payment or trade flows.

For Business For Individuals

Why is BLOCKBUCKS unique?

BlockBucks elevates transactions, enabling businesses to secure new revenue streams without added risk or complexity. BlockBucks is meticulously designed to address the challenges faced by global businesses and payment processors by guaranteeing scalability, compliance, speed, and security.

BlockBucks solutions empower users with the ability to:

Simple & Reliable.

Simpler remembers your important details, so you can fill carts, not forms. And everything is encrypted so you can speed safely through checkout.

Transfer Faster

Speed through checkout and offset delivery at the same time.

Track better

Get real-time delivery updates from cart to home in one place.

Less Cost

With minimal charges

Facts & Questions

Have a question? Read through our FAQ below. If you can't find an answer,

please email our support team. We're here to help.

As financial institutions strive for efficiency and customer satisfaction in cross-border transactions, there is a pressing need to address challenges related to prolonged processing times and intricate routing.

Optimizing cross-border payments is crucial for offering the best customer experience and removing frictions from the process.

Using the power of AI, the goal is to assist banks in discovering the channel which is the most cost effective, transparent, accessible, and fast to banks' customers.

Features used by Algorithm to find the optimal path

✔ Tech providers categorized by country

✔ Costs associated with completing transfers

✔ Duration required to complete transfers

✔ Currencies compatible with various solution options for each

transaction

Drawing from our established metrics and mapping, we have developed a solution that places emphasis on both cost-effectiveness and speed. Our strategy remains impartial to individual technology providers, allowing for flexibility in integration.

Through this approach, we will interface with a range of providers. Moreover, armed with comprehensive datasets delineating transaction costs, durations, and operational countries, we will identify the most advantageous route. This entails selecting providers that deliver both economical and expedient services.

✔ Provides end to end transparency from sender to recipient in transaction journey.

✔ Fully transparent which technology providers are used at every stage of transaction.

✔ At every stage of transaction, we show how different forms of the fiat gets transformed.